Some Other Stuff I Want to Share, Volume II

What would happen if you gave a homeless person a pre-paid debit card? That’s what a writer for the Toronto Star explored in 2010. Related: NPR has a story about a charity which gives money to impoverished people in developing countries, with no strings attached. The results are similar.

* * *

If you’re not following CGP Grey’s videos on YouTube, you should be. He creates great, incredibly informative videos on topics you’d not think to explore. I asked him which one was his favorite, and he said it was this one, below, explaining the difference between Holland and the Netherlands. If you’re a long-time Now I Know reader, you may have seen this before, as I mention it in the bonus fact of this issue of the newsletter.

While we’re on the topic of CGP Grey, you should probably follow him on Twitter, as he makes other interesting observations such as this one. And if you’re a redditor, he has a subreddit which he’s active on, here.

* * *

Two long-ish quotes about the education system: I found both of the mind-boggling, and am passing them along without further comment:

One:

Anne Ruggles Gere, a professor at the University of Michigan, serves as director of the Sweetland Center for Writing, which oversees first-year writing at the university. She speaks with SAT essay-graders often. “What they tell me is that they go through a very regimented scoring process, and the goal of that process is to produce so many units of work in a very short period of time,” she says. “So if they take more than about three minutes to read and score these essays, they are eliminated from the job of scoring.” According to Perelman, especially speedy graders are rewarded for their efforts. “They expect readers to read a minimum of 20 essays an hour,” he says. “But readers get a bonus if they read 30 essays an hour, which is two minutes per essay.”

Two:

Back in California, when I raised the issue of too much homework on that e?mail chain, about half the parents were pleased that someone had brought this up, and many had already spoken to the math teacher about it. Others were eager to approach school officials. But at least one parent didn’t agree, and forwarded the whole exchange to the teacher in question.

As the person who instigated the conversation, I was called in to the vice principal’s office and accused of cyberbullying. I suggested that parents’ meeting to discuss their children’s education was generally a positive thing; we merely chose to have our meeting in cyberspace instead of the school cafeteria.

He disagreed, saying the teacher felt threatened. And he added that students weren’t allowed to cyberbully, so parents should be held to the same standard.

I explained that we never intended for the teacher to read those notes. This was a forum where we were airing our concerns.

What was frustrating me was that the underlying issue of ridiculous amounts of busywork was getting buried beneath the supposed method we had used to discuss the issue.

* * *

Quick Hits:

- I’ve wasted way too much time playing this game. Now, you will too.

- LEGO Riddles.

- An incredible gallery of photos from around the world, showing what a weeks’ worth of groceries look like. It’s really interesting to compare some, like Italy versus Egypt.

- I wrote for free about writing for free on Medium. That took a while, which is probably why I didn’t write all that much above.

- The Spanish equivalent of “eye candy” is “tacos de ojo,” or “eye tacos.” But if you followed me on Twitter, you’d know that already.

- What happens when you pour liquid nitrogen on a giant knock-off Koosh ball? This. (Confession: When I first saw this link, I got really excited because I have a giant knock-off Koosh ball… and then I realized that wait, the liquid nitrogen is the hard-to-get part of the recipe.)

Some Other Stuff I Want to Share, Volume I

I’m trying something new here. It’s going to be a running list of stuff that I’ve thinking about but am not otherwise writing about (which is to say, isn’t likely going to be a Now I Know). I’m loosely following a format I used a decade (wow!) ago when I got my start as an erstwhile sportswriter, but I’m not sure how it’s going to totally play out yet. Suffice it to say that this is actually a long time coming — I’ve been thinking about this for a long, long time but haven’t been able to figure out the details, so I’m just going to figure it out as I go along. If you’d like to reply to anything below, or about this idea generally, please let me know. I’d prefer if you sent me a tweet (it’s easiest for me) but email is a good-enough second choice.

Anyway, let’s get on with the show.

* * *

Shel Silverstein was an author and cartoonist some of the world’s greatest children’s books — Where the Sidewalk Ends, A Light in the Attic, and a bunch of other stuff. But he also wrote a lot of non-children’s work, including cartoons for Playboy. He’s an interesting person, but he’ll never write an autobiography — he can’t, because he died in 1999.

But Joseph Thomas, a professor at San Diego State University, wants to write the definitive Shel Silverstein biography. He’s been studying the poet/cartoonists work for years and when you read this article on Slate, you’ll likely find Silverstein as fascinating as Thomas does. Unfortunately, you’ll also learn that Thomas won’t likely be able to publish the biography — because of a really strange unintended consequence of how American copyright law plays out.

Thomas wants to quote Silverstein’s works in his book, which is a mix between “obvious” and “necessary,” given what the former is writing. And legally, he should be able to. I was once a lawyer — that’s my I-can’t-still-give-legal-opinions legal opinion on the matter. It’s most likely fair use, which is described here.

The problem? First, fair use gets argued in front of a judge, and therefore, is an expensive thing to assert — you have to hire lawyers and all that stuff. Second, the fair use analysis is a fickle beast, and there’s always a non-zero chance you’re going to lose — so it can be VERY expensive. And while the universe would probably be better off if Mr. Thomas gets to publish his biography of Mr. Silverstein, well, let’s face it, there’s not a lot of money in it for anyone. The publisher can’t afford to take the risk of having to pay off a bunch of legal bills (if not worse).

Typically, an author and/or publisher will get permission from the rights holder — in this case, Silverstein’s estate — and avoid the legal ambiguities above. But Silverstein’s estate refused to grant these rights. I don’t think there’s anything nefarious going on here, by the way; Silverstein apparently was a big believer in the medium being a large part of the message, and taking his poems and cartoons out of the mediums in which they were published would, in his mind (assuming he were still alive), change them dramatically. So his estate is simply carrying out that wish. Regardless, Thomas therefore can’t find a publisher who will take his work and turn it into a book. Self-publishing isn’t an option for the same reason.

This is a ridiculous outcome, and a serious flaw in American copyright jurisprudence. Fundamentally, the fair use doctrine exists to make sure that copyright doesn’t trump the First Amendment, and to protect discourse and the marketplace of ideas generally. Being able to survive a lawsuit, financially speaking, shouldn’t be a prerequisite.

Read the whole thing at Slate.

* * *

In the U.S., we tend to rate non-profits based on how much of their annual budget goes toward the problem they’re aimed at solving. The video above is 19 minutes long and will have you thinking for at least five times that. Dan Pallotta, the speaker (here’s his Wikipedia entry) makes a few really interesting points arguing that (a) that’s the wrong way to measure what we’re after and (b) other factors limit our ability to solve the large scale problems out there. Worth watching the whole thing.

* * *

Quick hits: This is a ship-shipping ship, shipping shipping ships. … One of the early Now I Know articles I wrote was about how the Earth has a finite amount of helium, and how it’s incredibly underpriced given the scarcity. According to a recent Washington Post article, that’s actually being addressed. … Mental Floss interviews the generally reclusive, incredibly interesting Bill Watterson. If the name isn’t immediately recognizable, he’s the cartoonist who brought Calvin and Hobbes to the world. The interview is a HUGE win for Mental Floss, who has no idea why Watterson picked them. … If you’re a baseball fan, this guy’s attempt to go 9 innings with Mariano Rivera in MLB 13 The Show is a great story. If you don’t know what that means, oh well. … The Dutch have created an “eco-friendly bicycle bus” to transport school children.

Originally published on October 22, 2013The Now I Know Book Comes Out Tomorrow!

Hi!

Tomorrow, officially, my book comes out. If you haven’t ordered it already, you can online at Amazon, Barnes and Noble, or Powell’s, and it should be on shelves at B&N as well as a bunch of independent bookstores, too.

A lot of you have been asking questions about the book, how you can help, etc. So, here are some answers!

1) Want to help spread the word? Please consider posting about the book on your social media accounts, particularly Facebook and Twitter, and anywhere else you think is appropriate. If you’ve bought the book, please also leave a review on Amazon, here. (If you haven’t, please don’t do that, because Amazon doesn’t take kindly to false reviews, apparently.)

2) If you’d like to make a bulk order — 10 or more books, for gifts, events, corporate giveaways, or whatever — please email me, and I’ll connect you up with the publisher.

3) Not convinced yet? My friends at Smithsonian Magazine have run an excerpt, here. It’s one of the fifty stories which aren’t from the email newsletter you’re already subscribed to, and you’ll see the format and voice are very similar to the email.

Thanks for reading and for your continued support. I’ll be in your inboxes again tomorrow with Friday’s edition of Now I Know.

Originally published on October 17, 2013Teaching What’s Important

I was on the 5:46 train from Manhattan to Westchester yesterday. The first stop was White Plains and almost everyone gone off. A lot of people were standing, including me. Two of the other guys standing were 20-somethings who, given my eavesdropping, seemed to have entry-level-ish sales jobs. Somehow or another, they started talking about population density, wondering aloud which state had the lowest. We were underground, so it was going to be a few minutes before one of the could fire up an iPhone web browser and Google their way to a Wikipedia entry. Instead of just accessing the answer within a minute or two, they swapped speculation.

* * *

Earlier in the day, I read this article about the incredibly large amount of homework that middle schoolers get. It’s a great read, so click the link and take a moment to peruse it at least, or bookmark it for later or something. For now, though, focus on this part:

Another exercise required Esmee [the author’s daughter, then in sixth grade] to find the distance from Sacramento—we were living in California—to every other state capital in America, in miles and kilometers. This last one caused me to question the value of the homework.

What possible purpose could this serve?, I asked her teacher in a meeting.

She explained that this sort of cross-disciplinary learning—state capitals in a math class—was now popular. She added that by now, Esmee should know all her state capitals. She went on to say that in class, when the students had been asked to name the capital of Texas, Esmee answered Texas City.

But this is a math class, I said. I don’t even know the state capitals.

I don’t agree with the author here, generally. I don’t see an issue with cross-disciplinary learning and actually see it as a net positive good idea, although that’s definitely a lay opinion. (In fact, everything here is a lay opinion — I’m just a guy with a good head on my shoulders, and not an expert on education at any level.) If you’re going to learn how to measure distance in math class, which makes sense to me, it further makes sense that you’d be better off doing so with some sort of practical application attached. Now, state capitals is an odd choice, because there’s little practical application in knowing how far Sacramento is to Jefferson City, Missouri. The odds of that having any relevance in your life, especially as a 12-year-old, is roughly zero, so it probably doesn’t aid you in learning about the math. And it also doesn’t tell you anything important about the world at large.

In short, why does Esmee have to know her state capitals?

* * *

Wyoming.

That was the first state that popped into my head. Very small population — the smallest among the states — and relatively large in land area. That’s a great recipe if you want a low population density. And then I remembered Alaska.

The maps screw with our sense of things, I think. Alaska isn’t to scale in most any map you’ll see, for a variety of reasons. But it’s huge. It’s bigger than Texas. It’s bigger than California. It’s bigger than Montana. Sure. But did you know that it’s bigger than all three of those states — combined? Alaska is huge.

If you know that, even if it’s just a glib memory of that fact, Alaska is clearly the right answer — once you remember that Alaska is a state, which make take a moment. But that’s not what happened on the train. The two sales guys were talking, and one said “Alaska” and the other said “one of the Dakotas.” That’s not a terrible guess — the Dakotas rank 46th (South) and 47th (North) in population density. But they have an average population density of about 10 people per square mile, compared to about 1.25 people per square mile in Alaska. That’s an 8:1 ratio. West Virginia has a population density of approximately 77 people per square mile, which is (very roughly) a 7:1 ratio compared to the Dakotas. West Virginia is the 29th most populous state in the Union. The ordinal gap between the Dakotas and Alaska is incredibly misleading. Alaska is the least dense state in the U.S., and it isn’t close. At all.

* * *

The train was more crowded than usual but it wasn’t a big deal. The trip was about 45 minutes and while standing isn’t fun, it’s doable, even if you have to do it every day. (I typically get a seat, though.) By my count, there were about 125 people on my train car. There were eight cars. Less than ten minutes behind us, there was another train — the 5:51 — which I almost had to take because I barely made the one I was on. It was likely packed as well. That’s sixteen cars, each of about 125 people, all going to the same place at the same time and not really thinking much about it. Commuting is just part of the daily routine.

* * *

The population of Alaska isn’t evenly distributed. Of the 730,000 or so who live there, nearly 300,000 live in Anchorage. Fairbanks is second with about 31,500 and Juneau is third with 31,200 or so. Juneau is the capital. It is 2,464 miles (3,965 km) from Sacramento.

Juneau is tiny. My home state of Connecticut has 30 different municipalities with a large population. Juneau is roughly the size of Newington, Connecticut, which has about 30,500 residents. Newington is roughly 3,000 miles (4,828 km) from Sacramento. The number of people who care about that is roughly zero, because it’s wholly unimportant. The distance from Sacramento to Juneau is only marginally more important.

That’s because the mere fact that Juneau is Alaska’s capital tells you nothing about Alaska’s culture, demographics, or anything else. There’s a certain arbitrariness here — Anchorage has 40% of the state’s population and is ten times the size of Juneau. Would making Newington the capital of Connecticut make it important? Hardly.

The distance from Sacramento to Juneau is roughly (very roughly) the same as the distance from Sacramento the similarly town of Newington. That tells us nothing. We’re teaching the unimportant stuff and making it seem important.

* * *

After figuring out that Alaska was the least densely populated state, the two guys started wondering what the most densely populated state was. One said (with conviction) New Jersey, which is the correct answer, at 1, 205 people per square mile. The other guessed Rhode Island, which at 1,016 people per square mile, is second. It’s a solid guess, especially when you see that the drop-off to #3 (Massachusetts, 852 people per square mile) is rather large.

Rhode Island is slightly over a million people, which puts it 43rd in population among the states. It’s the smallest state by area, at about 1,200 square miles, which is why its population density ranks so high. No surprises there.

* * *

So let’s do some math. Just like Esmee had to. But instead of learning distances, let’s do some division and multiplication and fractions and that stuff.

- The population density of Alaska is 1.25 people per square mile.

- There are about 125 people on my train car.

- There are eight cars on my train, and I had my choice of two equally-crowded trains. So that’s 16 train cars.

Those last two bullets are my (basically) everyday life. It’s part of my culture and the culture of the entire Westchester area — even those who don’t commute. And if those of us on the train — not our families, neighbors, or friends, but just those of us commuting — had to spread out to match the population density of Alaska, we’d need 1,600 square miles. (Really, the math is easy.)

Rhode Island is only 1,200 square miles. We’d need one and one-third Rhode Islands, just for those of us who commute home from New York City to the White Plains area between 5:46 and 5:51 each afternoon. It’s pretty clear, from this, that Alaska is very, very different than the New York City suburbs I now live in. And to get there, I had to learn math. And when I did it, the math had meaning.

Shouldn’t this be how we teach?

Originally published on September 27, 2013Now I Know: It’s a Book!

I sent the below to my Now I Know subscribers today.

—

Hi!

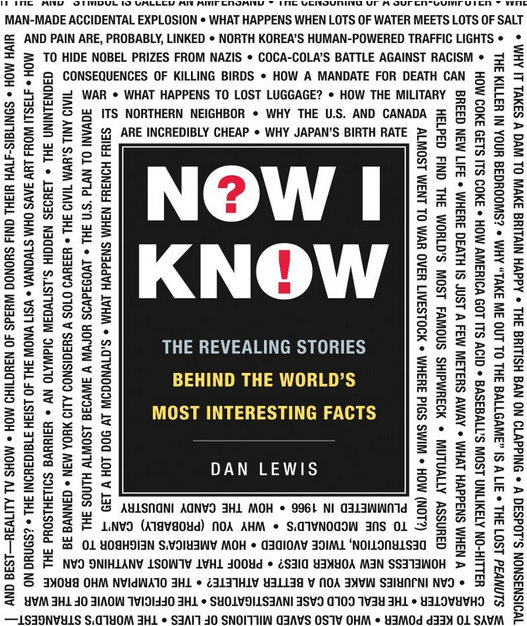

As promised, I have big news to share today. The subject line of this email probably gave it away. Available for pre-order, today, is Now I Know: The Book. Here’s the cover:

You can order it on Amazon or Barnes and Noble. The book comes out on October 18th, and I’m incredibly excited to finally be able to share the news with all of you.

It’s about 250 pages long and contains 100 stories, just like the ones you’d expect in the newsletter — bonus facts and all. Fifty of the entries are brand new, and there are about 53 or so never-before-seen bonus facts — I kind of lost count along the way. Regardless, it’s more of what you’re used to, bound together on paper with a side order of ink.

I hope you’ll enjoy it and consider giving it as a gift, too. And when it arrives, please be sure to leave it a review online. But for now, here are those links again: Amazon, B&N.

Thanks for reading and for your continued support. I’ll be in your inboxes again tomorrow with another Now I Know.

Yours,

Dan

Originally published on August 1, 2013The Spread of a False Fact

If you subscribe to Now I Know, my email newsletter of interesting facts, you know that I have a decent eye for topics. Over the weekend, I was writing up one I had come across a few weeks earlier. Apparently, India is about to discontinue its use of the telegraph, and the last telegram in the world (!!!) will be sent on July 14th.

Apparently. It’s not true. Here’s what I wrote (feel free to skip it) before I realized the error 1:

Dot Dash Dot, Dot Dot, Dot Dash Dash Dot

Born: March 24: 1844

Died: July 14, 2013 — absent a midnight-hour intervention.

Such is the fate of the telegraph.

On the first date above, Samuel Morse, in Washington, D.C., with members of the U.S. Congress gathered, sent a 18-letter message (encoded in dots and dashes) to his assistant, Albert Vail, waiting patiently in Baltimore. Vail returned the message — “what hath god wrought” with an implied question mark — changing history forever. For the first time, as the Atlantic’s Alexis Madrigal points out, this “mark[ed] the beginning of a new era of communication, in which information can travel faster than any human by means of conveyance.” And the end of that beginning is fast approaching.

As broadband internet and mobile communications technology has advanced, the value of the telegram has waned dramatically. In the U.S, Western Union discontinued the service in 2006, and at the time, a telegram cost $10 due to an increased reliance on third-party couriers. (Compare that to the cost of text messages, which even at a dime feel outrageously overpriced.) This ended the service in America, but many other areas still employed telegram offices for years subsequent. India is the last holdout. Until later this month, that is.

Telegram services in India are provided through a government-owned telecom company called Bharat Sanchar Nigam Limited, or BSNL. BSNL provides most of India’s landline telephone service as well (per Wikipedia, it has 75% of market share). It also has broadband Internet and mobile/cellular telephone offerings, but its footprint in those markets is not nearly as big. As the country becomes more and more digital and mobile, BSNL is finding its finances hurting — revenue is down and it posted a $1.5 billion loss in 2011-2012. Telegram services

And it ends there. It has all the making of an excellent story, except that the punchline is just plain wrong. Not only is BSNL’s decision to end telegram services not the end of the line for the telegram around the world, but it isn’t even the end of the line in India. What a you-know-what-storm.

What happened?

I was using this NBC News article as my main source, and it doesn’t say anything about the telegram’s impending eradication. I saved the article in my Instapaper account and the grabbed text also omits the “fact.” But I know I didn’t make it up, so a trip to Google helped me figure it out. And if you look carefully at the NBC News article, some of the evidence is still there:

Couples who’ve eloped to marry because their families disapprove of their union for caste or class or religious reasons, send telegrams as news to their parents, according to the Christian Science Monitor.

Check out the URL of the link to the CS Monitor article. It’s <http://www.csmonitor.com/World/Asia-South-Central/2013/0614/India-to-send-world-s-last-telegram.-Stop>. See? World’s last telegram. But if you click the link, you’ll see that the URL is now <http://www.csmonitor.com/World/Asia-South-Central/2013/0614/India-to-end-state-run-telegram-service.-Stop> and there’s an “Editor’s Note” at the top of the piece:

The original story incorrectly heralded the worldwide demise of the telegram. In fact, some telegram services live on, including an international telegram service that will continue to operate in India even as the state-run service is shutting down.

Unfortunately, a lot of the harm was already done by then. Here are a selection of places which have now published a story about the world’s last telegram, without any update on that article itself:

- Business Insider, which republished the CS Monitor article before the correction hit

- Slate

- Fox News, which the New York Post republished

- USA Today (via Newser); the Huffington Post also republished part of Newser’s report

- And unfortunately, one of my favorite blogs, Marginal Revolution.

I don’t exactly know why my skepticism radar went off when it did. I wanted to see why BSNL was shutting down the telegram service and was going to write “Telegram services cost BSNL $______ per year,” and expected that item to be in the NBC News article. When it wasn’t, I went searching, and I just couldn’t find it. In fact, the body of the Wikipedia entry for BSNL at the time of this writing only mentions the word “telegram” once:

BSNL announced the discontinuation of its telegram services from 15 July 2013, after 160 years in service. It was opened to public in February 1855, in 2010 it was upgraded to a web-based messaging system in 2010, through 182 telegraph offices across India.

That’s likely when the “oh no” moment hit me, now that I think about it. There’s no way that the Wikipedia entry would mention the end of the telegram service and fail to mention that it was the last telegram service anywhere… right?

So I poked around Wikipedia some more. Eventually, I found a this summary of the status of telegram services worldwide. It’s not short. There are a lot of countries still using the telegram in one capacity or another.

We’ll see if anyone spreads the fact further over the next few weeks.

Notes:

- The title was awesome, too. 🙁 ↩

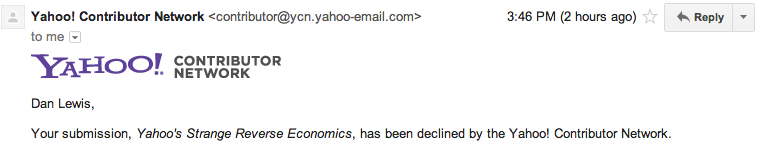

Yahoo’s Strange Reverse Economics

I tried to write this for the Yahoo! Content Network, which is explained below. But they rejected it (and took a week or so to do so), so most of what you’re reading is illustrative and not accurate. (You’ll see.) The point still holds, so I’ve published it below the screenshot of the rejection email.

You’re reading this via Yahoo!’s Contributor Network. It’s a biproduct of a company called Associated Content (here’s their Wikipedia entry) which Yahoo! bought two years ago this week for about $90 million. The way it works? People like me — random, basically anonymous people in the eyes of Yahoo! — go tovoices.yahoo.com, click to sign up, and start writing. (It takes a few minutes; I joined the Contributor Network about three minutes before writing this sentence.) If your article is accepted, Yahoo! will pay you, and the rates actually aren’t terrible. Well, the flat rate is, at $2 to $15 for an unsolicited piece like this one, max, and many get $0. But there’s a “performance” rate too. A post on the Voices network could get you $2 CPM — that’s $2 per 1000 pageviews — which isn’t bad at all for basically random content.

But I’m not writing this here for the handful of quarters that this may earn. I’m writing it here to demonstrate a point. Like most everything else I’ve written to date, if anyone reads this, it’s going to be because I’ve tried to bring the first round of readers to this article. There’s little chance of this being featured by Yahoo! (especially because of the topic, but put that aside). Yahoo! sees value in whatever traffic I bring in, and that’s really the only reason they’re allowing it to be published here.

Yahoo!, of course, has professional writers who create the content for Yahoo! News and the rest of their network. Take, for example, this article about Taylor Swift not being a Justin Bieber fan. Yahoo! paid the writer to write that, and, I assume, the author isn’t the one driving traffic there. It’s coming from the omg.yahoo.com front page; that’s why it has dozens of comments in about an hour and a half. And here’s another bet I’m willing to make: Yahoo! pays that writer a lot more than the functional equivalent of the $2 to $15 flat rate she’d get if it were a left-for-dead Y! Contributor Network article. And how much traffic does she have to drive to earn any money? Zero.

In short: Yahoo! pays more for writers than it does for traffic drivers.

This is a very traditional route, akin to what the New York Times and legacy media companies do, but it doesn’t make a lot sense in the digital, massively defragmented world Yahoo! actually exists in. Most articles that they feature are increasingly a commodity, yet they pay those top dollar. On the other side, there are individual with audiences who are willing to send those audiences to Yahoo!’s sites — and therefore, to Y!’s ad impressions — for a cut.

But instead of embracing this, Yahoo! seems to be running away. They just bought Tumblr for two orders of magnitude more than they paid for Associated Content, and there’s little reason to believe that any of the Tumblr bloggers. Most Tumblr bloggers shouldn’t get paid, of course, just like most random essays written on the Y! Contributors Network won’t garner any pageviews and therefore won’t earn any pennies. But there are a few Tumblr users who have really large audiences. Take this guy, for example, who writes for four different sports Tumblrs with more than half a million followers each. At this point, he could pretty easily drive thousands of page views a day just by producing content within the Yahoo-owned Tumblr ecosystem. But will Yahoo! pay him for it?

I doubt it. What he does is a lot more valuable than this article. But if you’re reading this, I’m getting paid.

This is backward. Yahoo! should find a way to pay the traffic drivers, not (just) the writers.

Originally published on May 27, 2013Reversing the “Write For Free, Gain Exposure!” Offer

“We’d love to have you write for us. We can’t pay you, but it’d be great exposure for your work!”

If you’ve tried to write for someone else online, you’ve probably heard that offer. It may be worth it, it may not be. It all depends. I’ve done it many times while building Now I Know, and it definitely helped. (And if the opportunity were right, the below notwithstanding, I’d do it again.) But your experience may differ.

Now that I’ve gotten a lot of “great exposure,” though, I’m making an offer to potential publishers.

I’ve love to write for you. You have to pay me, but it’d be great exposure for your publication!

Here’s how it works.

1) You tell me you want to write for you.

2) I come up with some potential topics. You pick one.

3) We figure out how much you’re going to pay me.

4) I write. You publish. I promote my work.

Pretty simple.

I’m pretty good at driving traffic to what I write. My email newsletter has 85,000 or so subscribers, so I can plug it there if appropriate — and, because I’m the one writing whatever we collectively come up with, it probably is. And even outside of that, I’m pretty good at getting attention for the things I work on.

Proof? Google “dan lewis google reader petition” for example. I didn’t promote that on the newsletter, but it received 150,000 signatures and all that press. I wrote about how I found out about an island nation that ran out of bird poop: 2,700 pageviews. I explained why I think the backlash to Zach Braff and Amanda Palmer’s Kickstarters is no big deal: 14,000 pageviews, and Palmer herself read it. And I taught my 5 year old about square roots: 40,000 pageviews. I can bring exposure.

So, let’s reverse the offer. I write — that part stays the same — but you pay for exposure. Interested? Shoot me an email. dan.lewis at gmail.

Originally published on May 22, 2013The Shep Diagram and Data in the Digital Age

I originally published this on Beyond The Boxscore, here.

One of the cooler things that has emerged this season is the “Shep Diagram,” a series of animated images/video layered into one. It began about a week ago when a reddit user named DShep created the image below. The image was picked up by Deadspin and FanGraphs and a bunch of other places because its incredible, but also because it shows how incredible Yu Darvish is due in part to his consistent release point.

(If that doesn’t animate, click here.)

Just a day or two ago, MLB Network created their own Shep Diagram for Justin Verlander — watch it here — showing how four of his pitches can look the same coming out of his hand. This method of displaying information is relatively new, but it is taking off fast, in large part because it feels useful nearly immediately.

We haven’t seen data displayed like this much in the past. Sure, we have heat maps and PitchFX data etc., but it’s rare that we’re using actual game footage in this manner. Take, for example, this 2010 New York Times Interactive piece on Mariano Rivera’s effectiveness. They show us a computer-generated representation of over 2000 pitches, and at the time (and now), it’s an incredible way to look at the game. As the Shep Diagram demonstrates, though, it’s just the tip of the iceberg.

Fifteen years ago, we were just at the beginning of the era where digital publishing tools and broadband access were enabling the growth of user-generated content. The skill set of the people who were able to gain access to those tools included literacy and a basic understanding of math, and because of that, we have a wealth of ways to explore baseball via words, spreadsheets, and formulas. As tools and skill sets involving digital video editing become better and more mainstream, hopefully we’ll see more things like the Shep Diagram above. A picture is worth 1,000 words; these things are worth ten times that.

Originally published on May 2, 2013Runs Produced, Ground Rule Doubles, and the Internet Hits a Homer

This is about baseball. It’s also about digital media, but it won’t make sense if you don’t understand baseball.

In the early to mid 1990s, USA Today had this weekly paper called Baseball Weekly. Now it’s Sports Weekly and irrelevant, but at the time, it was groundbreaking — a must-have for a baseball fan. Fantasy baseball was picking up steam at the time and they had ad after ad for the call in, pay-for-transactions leagues which I don’t think exist anymore.

Baseball Weekly, for a time, had a stat called “Runs Produced.” Runs scored (RS) plus Runs Batted In (RBI) minus Home Runs (HR). Runs Produced wasn’t new. Bill James, a forefather of advanced baseball stats (“sabermetrics,” usually), mentioned it in his 1987 annual, and considered it old and wrong. But it stuck around for decades. I recall hearing Mike and the Mad Dog (back when they were still a team) on WFAN discussing it as recently as ten years ago. In 2007, Tom Tango, a guy in the upper echelons of the advanced baseball stats world, wrote this article discussing Runs Produced. The stat, though, is junk, and you’ll have a hard time trying to find anyone who still uses it.

Runs Produced assumes that the batter’s only job is to produce runs. That makes sense — and even modern, advanced metrics make that assumption. But at the time Runs Produced was conceived, two of the core stats collected were “runs scored” and “RBI.” Both spoke to the idea of a player producing a run, either by crossing home plate (RS) or by getting the hit that allowed the runner to do that (RBI). But a home run did both of those, so to avoid double-counting, Runs Produced sums RS and RBI and subtracts out HR. The narrative, on its face, makes sense. Especially when Mike and the Mad Dog take up a dozen minutes of air time to explain it.

But imagine the following two situations:

1) A batter hits a home run. One RS, one RBI, one HR — that’s 1+1-1 = 1 Run Produced.

2) The first batter of the inning walks. The next one, we’ll call him ScoringGuy, hits into a fielder’s choice — the guy who was on first is out at second, and ScoringGuy is safe at first. The guy after him hits a ground rule double, moving ScoringGuy to third. The next batter, BattingInGuy, hits a weak grounder up the first base line, grounding out — but ScoringGuy (and the runner on second) advance in the process. That’s a run for ScoringGuy and an RBI for BattingInGuy. Both ScoringGuy and BattingInGuy “earned” one Run Produced.

The first obvious flaw here is that both ScoringGuy and BattingInGuy did very little to produce that run. ScoringGuy ended up on first base by fluke, replacing the guy before him; BattingInGuy’s weak dribbler only ended up scoring a run because of another fluke — there happened to be a guy on third with fewer than two outs. Both get a Run Produced, but the person who did the yeoman’s work in the inning — the guy who hit the ground rule double — gets nothing.

The other obvious flaw is that the batter who hit a home run in situation one did a lot more than BattingInGuy and ScoringGuy, but all three get the same +1 Run Produced.

The third flaw, which is less obvious, is that situation #1 gave us +1 Run Produced and one run on the scoreboard, which is right. But situation #2 gave us +2 Runs Produced… and, also, only one run on the scoreboard.

In total, we end up with a stat which really makes no sense. So why didn’t Runs Produced die for decades?

My guess is that the proponents of the stat were media people who used it for some reason or another, and they had the power of the last word. Mike and the Mad Dog, for example, were never going to debate some caller about, well, anything. The hosts talk with the random caller for a few minutes, hang up, and then continue on. It’s not a fair fight. The Internet, of course, changed that, as those who objected to Runs Produced finally had a way to repeatedly and constantly push back. Sure, they couldn’t argue on WFAN, but they no longer had to, because the audience was everywhere, and not just tuned into the radio.

Now: imagine someone from media’s old guard tried to come up with a modern, ridiculous replacement for Runs Produced. (It isn’t hard to imagine.) In order for it to be adopted, the contrarians who killed Runs Produced — the Internet riffraff — now have to adopt it. We all know it’s a new world, at least insofar as the marketplace of ideas is concerned. But do we realize how new, yet?

Originally published on May 1, 2013